Loopholes of the tax system

- By FE -- 6 minutes read --

- Jan 12, 24

" Fuelling stress amongst ordinary people "

Many of the factors that contribute to tax evasion emerge due to the existing legal framework of our tax system. This ultimately fuels budget deficits and shifts the burden to the general consumers.

Firstly, Bangladesh's taxation system is regressive, allowing it to collect more money from the poor than from the rich. It is necessary to create a tax system that is fair for all the citizens of this country. According to Global VAT Compliance (GVT), Bangladesh has a 15 per cent standard VAT. The GST in Australia is 10 per cent. The Goods and Services Tax (GST) is an indirect taxation system imposed on goods and services. This is usually taxed at a single rate throughout the nation. On the other hand, Malaysia replaced its GST with SST and fixed the rate at around 6 to 8 per cent. Sales and Services Tax (SST) is a single-stage tax system imposed on all types of taxable goods produced and sold within the country. This clarifies that Bangladesh places more VAT on consumers comparatively.

As taxes are imposed on goods and services, it creates difficulty for people with low incomes. The increase in VAT on essential commodities as part of the proposed new 2023-24 fiscal year budget is expected to make living more expensive as the government increases taxes on the necessary goods. Low-income workers pay a 15 per cent tax on the goods they consume even if they earn less, sometimes using up most of their little income. Meanwhile, the wealthy feel the brunt of this increased taxation less due to its negligible impact on their income.

In addition, consumers who buy from supermarkets often get double-taxed. The shoppers at these stores are not necessarily all wealthy people, but those in the moderate to low-income bracket also shop at these places for the convenience of having all the items they need under one roof. These shoppers are taxed an extra 5 per cent on the packaged goods of the supermarkets, whereas they already pay 15 per cent when they purchase the products.

If we look at the education sector, the government has also imposed taxes on English-medium schools. As per the Income Tax Statutory Regulatory Order (SRO), English-medium schools pay about 25 per cent. The tax rates have been made equal for business companies and educational institutions. This is highly unwarranted for two reasons. Not every student who attends such institutions is from a wealthy background, and the tax rates should never be charged the same for two completely different types of organisations. Secondly, some corporations in Bangladesh contribute to the budget deficit. They allegedly avoid tax by transferring their profits out of the country. This helps them to underreport their actual profit and pay less tax. In this way, they pay less or no tax on the profit that has been shifted out. According to a Tax Justice Network (TJN) report, Bangladesh loses about $361 million worth of tax because of the shifting of profits by multinational companies. The corporate sector can shift $1.4 billion of profit from the country each year.

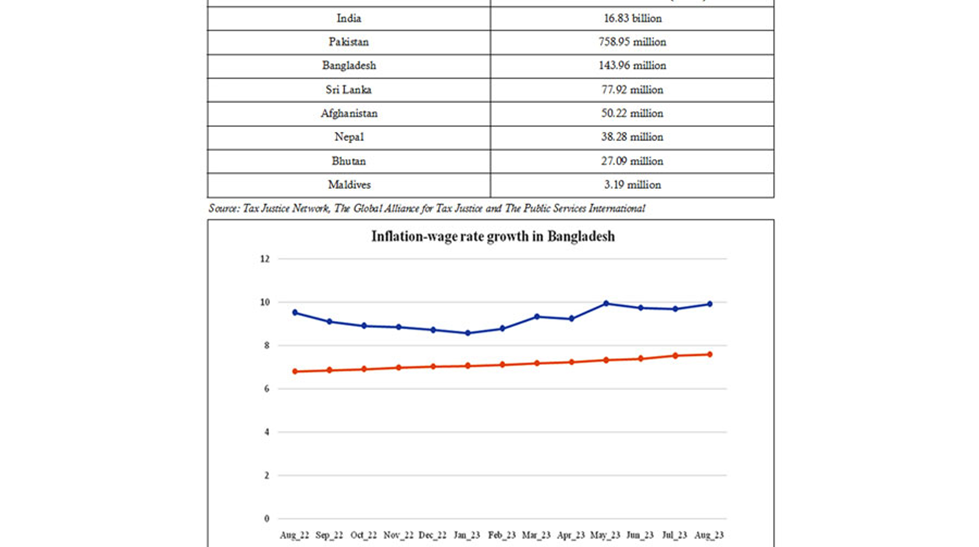

A report jointly published by The Tax Justice Network, The Global Alliance for Tax Justice, and The Public Services International shows how different South Asian countries lose their tax revenues. The report is titled "The State of Tax Justice 2021." Surprisingly, Bangladesh ranked third among all the other countries. The following table presents the data and shows how much different countries have lost in tax revenues (US$). It reveals that Bangladesh's tax revenue loss is $143.96 million, which makes it the third highest. It comes after India, with $16.83 billion losses, and Pakistan, with $758.95 million losses. After Bangladesh, Sri Lanka has $77.92 million in tax losses, and Afghanistan $50.22 million. Nepal and Bhutan lost $38.28 million and $27.09 million, respectively. Lastly, there is the Maldives, with only $3.19 million in tax revenue loss, though the report also adds that the Maldives does not encounter corporate tax abuse.

The intentional avoidance of corporate tax shifts the tax burden from corporate sectors to individuals as the consumption tax increases in each budget. Bangladesh has a higher consumption tax compared to many other countries. Furthermore, an increased burden is created by the several tax exemptions given to multinational corporations to draw in foreign investment. According to NBR, the government loses Tk 50 billion a year due to tax breaks for international corporations and money laundering. The budget deficit caused by this is ultimately placed on the general populace.

Lastly, a recent spike in inflation and a significant hike in consumer taxes for the fiscal year 2023 is worsening the debts of Bangladesh's middle class. The wealthy might choose to avail themselves of costly lawyers for tax loopholes or adopt other means of evading taxes. While people with low incomes might contribute more to the underground economy or fall below the minimum taxable income threshold, the burden of this tax increase is expected to affect middle-class people and raise the overall cost of living.

Regular people are the ones who suffer since their purchasing power has drastically decreased due to their earnings not in keeping with the inflation rate. The Bangladesh Bureau of Statistics data indicates that the past 12 months' pay growth has lagged behind the inflation rate. The horizontal axis shows data corresponding to each month, starting from August of 2022 until August of 2023. The vertical axis represents the value in percentages of the change in Bangladesh's inflation and wage rate growth rate. The middleclass grapples with a tax system that disproportionately burdens those least able to bear it.

The consequences of the flawed tax system extend beyond individual financial stress. It not only puts moderate-income citizens under financial strain, but it also slows down economic expansion. The Laffer curve, introduced by the economist Arthur Laffer, who popularised it in the 1970s, shows that as taxes increase, consumer spending is expected to contract, which leads to a ripple effect on businesses and overall economic activity. The government then fails to reach revenue target, leading to budget imbalances.

The highlighted flaws in the tax system discussed not only place an excessive financial burden on people with moderate income but also nurtures an atmosphere favourable to tax evasion. The solution to these problems within our tax system indicates it needs a restructuring. Firstly, the tax system is complex, so people often feel overburdened; their solution is to turn to others for help since they need help to grasp the jargon and processes. It would be easier to collect taxes if the tax system were more accessible and digitalised. Secondly, the government should concentrate on other areas of taxation and consider lowering VAT to give lower-income citizens' welfare a higher priority. They should also prohibit powerful business groups from availing tax benefits. Lastly, to alleviate the burden on the middle class, the tax threshold should be raised due to the general inflation rate in prices. As Bangladesh addresses these economic challenges, prioritising the welfare of the ordinary people is critical to fostering a sustainable and inclusive economic future.

.png)